Pre-Listing Appraisals in Atlanta (2026): Full Breakdown for FSBO and Traditional Sellers

If you’re listing your home in 2026—especially in metro Atlanta, Fulton, DeKalb, Cobb, or Gwinnett—and you’ve searched things like:

This blog is for you. Whether you're working with a real estate agent or selling For Sale By Owner (FSBO), here's the straightforward, localized, and updated 2026 breakdown of everything you’re searching for.

What Is a Pre-Listing Appraisal?

A pre-listing appraisal (or “pre-appraisal”) is a certified home value opinion before your home is listed. It’s performed by a licensed appraiser—not a real estate agent. Unlike a CMA (Comparative Market Analysis), which is free and often biased toward listing price strategy, a pre-listing appraisal is a USPAP-compliant report based on adjusted sales comps, condition ratings, and market trends.

Use it to:

Set a price that attracts buyers without leaving money on the table

Protect yourself during FSBO listings

Strengthen your negotiation stance when offers come in

What’s the Cost of a Pre-Listing Appraisal in 2026?

In Atlanta, expect to pay $450 to $675 for a standard single-family home appraisal.

FSBO sellers often view this as a small upfront investment to avoid much bigger pricing mistakes.

Where Can I Find the Best Pre-Listing Appraisal Near Me?

Look for appraisers who specialize in non-lender, residential seller appraisals. You don’t want a “refi-only” shop or a generic national chain.

If you’re in metro Atlanta, make sure your appraiser:

Knows your ZIP code (ex: East Point vs. Sandy Springs)

Has experience with FSBO and pricing strategy

Can deliver a report within 48–72 hours

REI Valuations & Advisory offers certified, seller-focused pre-listing appraisals throughout Atlanta, Fulton, DeKalb, Cobb, Gwinnett, and surrounding counties.

What’s the Cost of an Appraisal for FSBO Sellers?

The FSBO appraisal cost is the same as a pre-listing appraisal: around $450–$675 in 2026 for metro Atlanta.

The difference is in how it’s used:

FSBO sellers use it to replace the pricing expertise an agent would normally provide.

It serves as a trust-building tool with buyers—showing your price is justified by a third party.

FSBO sellers can include the appraisal as part of their listing packet or use it to push back on lowball offers.

What a Pre-Listing Appraisal Includes

Regardless of whether you’re FSBO or agent-listed, here’s what a standard pre-listing appraisal includes:

When to Order a Pre-Listing Appraisal in Atlanta

In 2026, homes in Decatur, East Atlanta, College Park, Marietta, and Norcross are seeing value swings based on block-by-block factors like zoning, school ratings, and condition upgrades. Order your appraisal:

After renovations are complete

Before listing photos or going live on the MLS or Zillow

If your home is unique, upgraded, or difficult to comp

Final Word for Atlanta Homeowners in 2026

If you searched:

Now you know:

It’s a real, certified valuation—not a CMA

It costs about $425–$675 in Atlanta

It helps FSBO and agent-assisted sellers price right

It builds buyer trust and prevents appraisal surprises later

Serving All of Metro Atlanta

REI Valuations & Advisory – Georgia Licensed Residential Appraiser

📞 (404) 693-3878

reivaluations@gmail.com

Request a Pre-Listing Appraisal

BONUS: Mention this blog and receive $25 off your 2026 pre-listing appraisal — available to the first 4 bookings this month.

February 1 2026 7:49pm

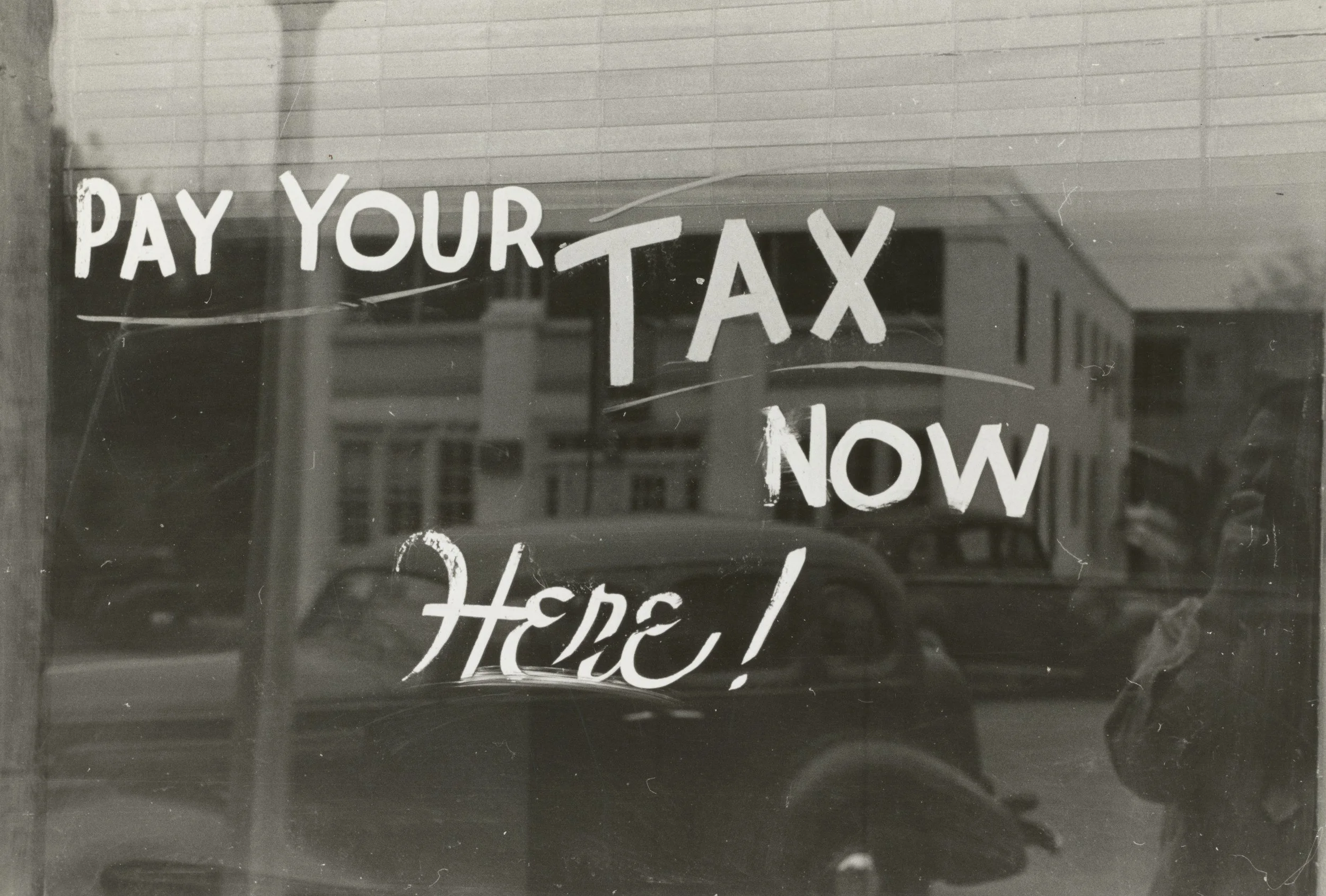

How to Appeal Your 2026 Georgia Property Tax Assessment: A Neutral Guide for Homeowners in Fulton, Cobb, Gwinnett & DeKalb Counties

Received your 2026 Notice of Assessment in Fulton, DeKalb, Cobb, or Gwinnett County?

Here’s a straightforward, impartial breakdown of how the property tax appeal process works in Georgia — including deadlines, steps, and common considerations for homeowners across the Atlanta metro area.

Step-by-Step: How to Appeal Your 2026 Property Tax Assessment in Georgia

1. Review Your Annual Notice of Assessment (NOA)

Every Georgia property owner receives a Notice of Assessment each year, typically between May and July. This document lists your property’s current fair market value, which your county uses to calculate your property tax bill.

Deadline: You have 45 days from the date listed on the NOA to file an appeal if you disagree with the value.

Where to Find It: The NOA is mailed and may also be available on your county’s tax assessor website.

2. Determine Whether You Wish to File an Appeal

There is no obligation to file an appeal. Some homeowners choose to do so when:

They believe the assessed value is higher than the property’s market value.

There are factual errors in the record (e.g., incorrect square footage or bedroom count).

Nearby comparable properties appear to be valued lower.

Others may choose not to appeal if the difference in tax burden is minimal, or if they feel the valuation is accurate.

3. Collect Supporting Information

If you decide to appeal, the county will request evidence to support your case. Typical forms of documentation include:

Sales comparables from similar nearby homes

Photos of property condition or deferred maintenance

Documentation of structural issues or limitations

Note: There is no required format for evidence, but the Board of Equalization (BOE) or hearing officer will weigh documentation accordingly.

4. Submit Your Appeal (Online or by Mail)

Appeals can usually be submitted:

Online via your county’s appeal portal (e.g., Fulton eFile system)

By mail or in person using the state’s PT-311A form

You may choose to appeal to one of three venues:

A Hearing Officer (for properties valued over $500,000)

Arbitration (requires appraisal and agreement to final ruling)

5. Attend Your Hearing (If Applicable)

If the county’s staff does not settle your appeal informally, it may move forward to a BOE hearing. You’ll be given a hearing date and can present your case in person. You are not required to have representation, but you may be represented by a family member, legal counsel, or a consultant if desired.

FAQ: Property Tax Appeal Considerations in Georgia

Is it worth protesting your property tax in 2026?

It depends. Some homeowners may reduce their tax burden through appeals. Others may not see significant changes or may prefer to accept the current valuation.How successful are appeals?

Counties do not publish formal success rates. However, anecdotal reports suggest that outcomes vary based on evidence quality, appeal venue, and county practices.What’s the deadline to appeal?

The deadline is 45 days from the NOA date. In 2026, most notices will be issued between May and July, but exact dates vary by county.Do you need to hire someone?

It is optional. Some homeowners represent themselves. Others choose to consult an attorney, a property tax appeal company, or an appraiser. The decision is personal and based on complexity, comfort level, and potential benefit.What evidence carries weight?

Counties may consider recent sales of comparable homes, appraisals, repair estimates, or documented inaccuracies in property records.

Interested in a Formal Valuation? Independent Appraisals Available Upon Request

If you decide that a formal, third-party appraisal would help you better understand your property’s market value for 2026 tax appeal purposes, REI Valuations & Advisory offers independent property appraisals across the Atlanta metro area.

No-pressure consultations are available through February and March 2026.

Service areas include: Fulton, DeKalb, Cobb, Gwinnett, Clayton, and Rockdale Counties

Appraisal reports are typically delivered in 5–7 business days after inspection.

Request a no-obligation quote here:

👉 www.rei-valuations.com/home-appraisal-request

January 31 2026 4:44pm

How Much Does a Pre-Listing Appraisal Cost in Atlanta (2026)? FSBO Homeowners, Read This First

“It’s 2026 in Atlanta, and the housing market is unpredictable. One seller gets three offers above asking. Another gets ghosted for weeks. What’s the difference?”

For FSBO sellers and homeowners listing their properties with an agent, the biggest hidden risk isn’t pricing too high. It’s pricing without data. That’s where a pre-listing appraisal can make or break your equity. In this Blog, we’re diving deep into the real cost, benefits, and timing of pre-appraisals in the Atlanta, Georgia market — especially if you're planning to sell in Q1 or Q2 of 2026.

Here are 7 brutal truths every Atlanta homeowner should face before listing a property in 2026 — especially if you're selling FSBO:

1. Zestimates Are Not Market Value.

They’re computer guesses. We’ve seen homes sell for $40K less than Zillow predicted — and the owner never knew until the appraisal came in too late.

2. “Testing the Market” Will Test Your Equity.

Listing too high = no showings. Listing too low = regret. Either way, the clock starts ticking once you're live — and every day unsold erodes negotiation power.

3. FSBO = You’re Alone Against the Buyer’s Team.

They’ve got an agent, a lender, a closing attorney — and you’ve got what? Maybe some YouTube research?

A pre-listing appraisal gives you ammunition.

4. Your Renovations Won’t Speak for Themselves.

Buyers don’t care that you spent $25K on tile. They care if it added value. An appraiser quantifies that — before they discount your asking price.

5. Agents Use Appraisers When They Want to Win.

Top realtors in Atlanta hire appraisers before listing high-end or hard-to-price homes. Why?

Because data justifies price better than salesmanship.

6. The Buyer’s Appraisal Comes Too Late.

Even if you get an offer, a low lender appraisal kills the deal. A pre-listing appraisal lets you price realistically and reduce fall-through risk.

7. Your Time on Market Becomes Public Record.

Buyers see “42 Days on Zillow” and smell desperation. A strong price, backed by a professional valuation, can make you look confident and in control.

Bottom Line?

A Pre-Listing Appraisal isn’t just a number — it’s your pricing weapon, your negotiation leverage, and your best protection against hidden risks in the 2026 Atlanta market.

What exactly is a pre-listing appraisal?

It’s a professional, third-party valuation ordered by you, not a buyer, agent, or lender.

It’s unbiased. It’s credible. And in today’s Atlanta market, it’s your single most powerful advantage before listing.

Whether you’re going For Sale By Owner (FSBO) or listing with an agent, a pre-listing appraisal tells you what the home is actually worth — based on local comps, adjustments, condition, and trends — not emotion, not Zillow.

Is this just for FSBO sellers?

Not even close.

We’re seeing a surge in homeowners using pre-listing appraisals as leverage even when working with agents. Why?

Because top-producing agents in Atlanta are quietly ordering appraisals before pricing premium or tricky homes — especially in 2026 where buyers are more price-sensitive, and appraisals can kill deals.

If you’re a FSBO seller? This is non-negotiable.

You don’t have the benefit of agent comps or internal MLS pricing tools.

This is how you avoid getting picked apart by buyers, investors, and their agents.

How much does a pre-listing appraisal cost in Atlanta in 2026?

Standard homes: $450–$675

Complex properties: $675+

FSBO advisory add-ons (optional): $75–$150 for a 1-on-1 pricing strategy call

We include zoning, market data, improvement impact analysis, and deliver a professional PDF report that you can show buyers, use in negotiations, and back up your price with confidence.

Will it help me sell faster or for more?

In many cases — yes.

We’ve seen homes sell 3x faster with a professional valuation cited in the listing — especially for FSBO sellers where buyers are skeptical of pricing.

Buyers are more confident, agents are less combative, and you avoid deals falling apart due to low lender appraisals.

Can I just use Redfin or Zillow instead?

Only if you're okay with being wrong by $25K to $80K.

Zestimates don’t inspect homes. They don’t consider condition, renovations, or location nuance (corner lots, views, school zones, etc.).

And buyers today — especially in Atlanta — are doing their own research. If your number feels off? They walk.

A licensed appraisal tells the whole story, with adjustments, comparables, and supportable logic that Zillow just can’t give you.

What if my home has recent upgrades or is unique?

That’s exactly when you need an appraisal.

If your home doesn’t match “cookie-cutter” comps, agents may price it wrong. Appraisers specialize in unique.

We quantify upgrades, assess market reaction to features, and calculate value add (not just cost).

This is critical if you’ve done recent renovations, additions, or energy-efficient upgrades in the last 12–24 months.

Is it worth it for homes under $400K?

Yes — especially if you’re FSBO.

The lower the price point, the less room there is for error. Even a $15K mispricing can destroy your negotiating position.

A $450 appraisal is insurance on your equity.

Will the buyer’s lender use this appraisal?

No — lenders order their own. But here’s the secret:

A pre-listing appraisal gives you control upfront, while the lender’s appraisal comes after you’re under contract — when it’s too late to reprice without blowing up the deal.

In short:

A pre-listing appraisal is your pricing strategy, your negotiation shield, and your credibility booster.

In 2026 Atlanta, when buyers are hesitant and interest rates are tight, this one move can protect your equity and speed up your sale.

Book Now Before Our March 2026 Calendar Fills

Want to list with confidence — and not leave equity on the table?

Limited-Time Bonus: Every pre-listing appraisal booked by Feb 15, 2026 includes a free 15-minute pricing strategy call with our lead appraiser.

Notice: Our calendar is currently booking 2–3 weeks in advance due to spring listing season demand.

Next Step:

Visit https://www.rei-valuations.com/

Or email us directly at reievaluations@gmail.com

Protect your equity. Own your listing strategy. Get your pre-listing appraisal today.

January 29 2026 6:43pm

Do You Need an IRS-Qualified Appraiser for Form 706 in Atlanta, Georgia? (2026 Guide)Everything You Need to Know About Estate, Gift, and Charitable Appraisals the IRS Will Actually Accept

If you're filing IRS Form 706 or handling estate, gift, or charitable contribution valuations in 2026, the last thing you want is for the IRS to reject your appraisal. But most homeowners, CPAs, and attorneys don’t realize this:

Not all appraisers are IRS-qualified. And not all appraisal reports meet IRS standards.

Whether you're managing an estate, planning to claim a step-up in basis, preparing for a gift tax filing, or itemizing a charitable donation—the valuation must comply with strict IRS regulations under the Pension Protection Act, IRS Pub. 561, and Form 706 guidelines.

So let’s break it down clearly—step-by-step.

7 Things You Absolutely Must Know Before Hiring an Appraiser for IRS Reporting

Here’s what most attorneys, fiduciaries, and family members don’t know—until it's too late:

1. Not All Appraisers Are IRS Qualified

To be recognized as a Qualified Appraiser under IRS guidelines, the person must:

Many brokers, agents, or even generalist appraisers do not qualify under Treasury Reg. § 1.170A-17.

2. Restricted-Use Appraisals Are Rarely Accepted by the IRS

If you're wondering, “Can I submit a restricted appraisal to the IRS?” — the answer is no for most estate, gift, and charitable cases. The IRS typically requires a complete, USPAP-compliant summary or self-contained report.

3. The Date of Death Must Be Clearly Stated

A proper Date of Death (DOD) appraisal must:

4. Valuation Mistakes Can Trigger Audits or Rejections

Common appraisal mistakes that cause IRS pushback:

5. Charitable Contribution Appraisals Must Meet a Different Standard

Donating real estate to a nonprofit? You’ll need:

Failing to follow this protocol can disqualify your entire deduction.

6. Appraisals for Gift Tax Filings Must Be Dated Properly

For gifts of real property, the appraisal must reflect the FMV as of the date the gift was made, not the date of report delivery. The IRS can challenge underreporting if your timing is off.

7. You May Need a Local Expert with Court-Ready Credentials

In high-value estates or audit-prone filings, you want an appraiser who is:

What the IRS—and Your Estate Plan—Actually Require (And How to Avoid Costly Mistakes)

If you're involved in estate settlement, probate filings, or strategic estate planning, here’s the bottom line:

The IRS does not accept just any appraisal.

Probate courts may reject poorly formatted or uncertified reports.

Filing late, using the wrong report type, or hiring an unqualified appraiser can delay distributions, trigger audits, and jeopardize deductions.

Whether you’re filing IRS Form 706, reporting a gift under Form 709, or documenting a charitable real estate donation, here’s exactly what the IRS—and most probate courts—require:

🔹 A USPAP-compliant appraisal report prepared by a Qualified Appraiser as defined under Treasury Reg. §1.170A-17

🔹 A retrospective date of death valuation (not current market value)

🔹 A full narrative appraisal, not a restricted-use report or desktop opinion

🔹 Proper fair market value methodology, per IRS Publication 561 and Reg. §20.2031‑1

🔹 Inclusion of the appraiser’s license, resume, signature, and certification

🔹 If charitable: a signed Form 8283 and full attachment for contributions over $5,000

🔹 If for probate: report formats and terminology acceptable to estate attorneys and Georgia probate courts

In short, if your appraisal isn’t IRS-ready and probate-compliant, it could cost your estate thousands in delayed filings, denied deductions, or contested distributions.

But the good news?

From high-net-worth estates with multi-property portfolios to routine date-of-death valuations for Form 706, we deliver court- and tax-ready reports that hold up to scrutiny.

Act Now — Bonus Consultation for IRS + Probate Filings (Limited Availability)

We are currently accepting engagements for 2026 tax season and probate court filings across the Atlanta metropolitan area.

Deadlines are strict. Audits are expensive. And qualified appraisers are in short supply.

Request your appraisal by February 15th, 2026, and receive a free 30-minute compliance consultation—where we’ll confirm:

Whether your situation qualifies for a restricted or full report

What scope and format your CPA, attorney, or probate court will need

What documentation the IRS is most likely to request

IRS & probate appraisal demand spikes from Feb to April. We limit new engagements to ensure turnaround compliance.

Request Your IRS-Compliant Appraisal Now »

Or call/text us directly at (404) 692‑3878 to secure your quote.

January 27 2026 7:44pm

Thinking of Selling Your Home in Atlanta, Georgia? Here’s Why a Pre-Listing Appraisal Could Be the Best Decision You Make in 2026

“Is a pre-listing appraisal worth it in this market?”

“If I’m selling FSBO, should I still get an appraisal?”

“What does a pre-listing appraisal even mean?”

If you’re asking these questions, you’re in the right place — especially if you're selling your home in Atlanta or surrounding metro counties like Cobb, Fulton, or Gwinnett in 2026.

Let’s break it all down clearly, step by step — and explain why more FSBO sellers and even agents are turning to professional appraisals before they ever list a property.

Step 1: What Exactly Is a Pre-Listing Appraisal?

A pre-listing appraisal is a professional, third-party opinion of your property’s market value — before you list it for sale. Unlike online estimates or agent CMAs, it’s an unbiased valuation backed by data, sales comparisons, and a certified real estate appraiser’s expertise.

If you’re selling For Sale By Owner (FSBO) in Atlanta or nearby counties, this appraisal becomes your anchor — helping you price your home right, avoid costly negotiations, and even justify value to buyers or agents.

Step 2: What’s the Real Value of Getting One in 2026?

Here’s what homeowners are seeing on the ground right now in Atlanta:

Pricing too high? You’ll sit on the market, drop price later, and lose negotiation power.

Pricing too low? You’re leaving tens of thousands in equity on the table.

Pricing just right with a pre-listing appraisal? You boost buyer confidence, create urgency, and set the tone from day one.

If you’re listing your home this spring or summer, especially in competitive zip codes like 30349, 30080, or 30331, a pre-listing appraisal isn’t just helpful — it’s strategic.

Step 3: Who Typically Uses These Appraisals in Atlanta?

You’re not alone — in fact, in 2026, these are the most common clients booking pre-listing appraisals with REI Valuations:

FSBO Sellers in Atlanta looking to price confidently and defend that price.

Seniors downsizing after decades of homeownership — often needing accurate value for equity planning or net sheet estimates.

Divorce or estate-driven sellers who want to document value before listing or splitting proceeds.

Agents listing unique homes where comps aren’t clear (e.g., mixed-use, large acreage, or unusual floor plans).

Investors flipping homes who need bulletproof pricing for fast resale.

Step 4: What Should You Do With the Appraisal Once You Get It?

This is where a good appraisal becomes a powerful tool:

✔️ Use it to set your list price

Use the final value as a data-backed anchor — especially helpful for FSBO or non-traditional listings.

✔️ Share it with buyers

It creates transparency and trust — especially when buyers don’t have comps of their own or are wary of seller pricing.

✔️ Present it to agents

If you're interviewing multiple agents, this gives you the upper hand when discussing pricing strategies — and filters out those who might overpromise just to get the listing.

✔️ Negotiate with confidence

If you receive lowball offers, your certified report helps you counter with objective support — not emotion.

Step 5: What Does the Pre-Listing Appraisal Process Look Like?

Here's what happens after you schedule with us:

Initial Call or Online Form

You fill out our quick form or schedule a brief Appraisal Fit Call. We clarify your goals — FSBO vs. listing with an agent, timeline, property details, and any unique features that might affect value.On-Site Inspection

We visit the property (typically within 1–3 business days). We measure square footage, take photos, and assess upgrades, layout, condition, and location characteristics that impact valuation — including proximity to top-performing schools, parks, or retail corridors.Data-Driven Valuation & Analysis

Behind the scenes, we run comps (recent sales in your immediate area), market trend data, and adjust for condition, GLA, and more. We then reconcile the final value — based on what your home would likely sell for today in your local Atlanta submarket.Report Delivery & Strategic Recap

Within 3–5 business days (or sooner if expedited), you’ll receive a PDF appraisal report you can use to set your list price or justify value to agents or buyers. Need help interpreting it? We offer a complimentary walk-through call.

Answering the Big Questions Sellers Are Asking in Atlanta, GA Right Now

How much does a pre-listing appraisal cost in Atlanta, Georgia?

Expect to invest around $375–$550 for a standard residential home in the Atlanta metro area. Complex properties, multi-family homes, or unique layouts may be slightly higher — but remember, this small cost can protect five or six figures in equity.

Is a pre-appraisal worth it for FSBO sellers?

Absolutely. FSBO sellers lack agent pricing guidance. A certified appraisal:

Establishes credibility with buyers

Reduces lowball offers

Builds trust during negotiations

How fast can I get a pre-listing appraisal near me?

Turnaround times in Atlanta are currently averaging 3–5 business days, but we offer expedited options if you're on a tight listing schedule.

What if I already have an agent?

Many agents encourage pre-listing appraisals — especially for unique homes or when comps are inconsistent. It helps them defend the list price and avoid pricing disputes later.

Bonus: What Makes Our Pre-Listing Appraisal Different?

We’re not just appraisers — we’re valuation specialists who understand the Atlanta real estate market street by street. With REI Valuations & Advisory:

You get court-ready, USPAP-compliant valuation documentation

Your report is tailored for FSBO, agent-assisted, or luxury listings

Our appraisals include a local market breakdown, not just boilerplate

You receive delivery guarantees (or we refund part of the fee)

And our 2026 bonus: Get $50 off your next appraisal when you refer a friend who lists their home in Georgia.

Don’t List Blind — Secure Your Appraisal Before You Hit the Market

Availability this week is limited — we're currently booking pre-listing appraisals across Cobb, Fulton, and Gwinnett counties.

Next-day appointments available (but only for the first 3 clients who book each week).

Bonus offer: Mention this blog and receive a free 30-minute pricing strategy call with your appraiser — no strings attached.

Schedule Your Pre-Listing Appraisal Today

Protect your equity. List with confidence. Sell with certainty.January 26 2026 3:49pm

How to Appeal Your Property Taxes in Georgia (2026 Atlanta Metro Guide)

A Step-by-Step Guide for Homeowners in Fulton, Cobb, DeKalb, and Surrounding Metro Counties. Feeling shocked by your new property tax bill? You’re not alone. Each year, thousands of Atlanta-area homeowners receive assessments that overstate their home’s true market value — and overpay because they didn’t realize they had options. This 2026 guide will walk you through everything you need to know to appeal your property taxes in Georgia, step-by-step, with local insight, deadlines, and evidence tips that most generic blogs miss.

Step 1: Understand the 2026 Appeal Window (It’s Short)

Every county in Georgia — including Fulton, Cobb, DeKalb, Gwinnett, and Paulding — mails out Annual Notice of Assessment letters, usually in April or May. From the date printed on that letter, you typically have 45 days to file an appeal.

Example: If your notice is dated May 1, you must file by June 15.

Miss it? You’ll have to wait until 2027 — even if the value is wrong.

Step 2: Decide If You Should Appeal

Ask yourself:

Does the assessed value seem higher than recent sales near you?

Has your home’s condition declined (repairs, age, damage)?

Are nearby homes assessed lower for similar features?

Have taxes increased substantially year over year?

If you answered yes to any of those, it may be worth appealing.

Pro Tip: Even if you bought your home recently, the county might not reflect your true purchase price.

Step 3: Gather Strong, Defensible Evidence

The success of your appeal hinges on proof — not emotion, not hope.

Best evidence includes:

A certified appraisal dated January 1.

Previous MLS sales comparables in your immediate area

Interior and exterior photos showing condition issues

Contractor repair estimates (if applicable)

Prior-year appraisals or appeal results (if your value was frozen)

Zillow “Zestimates,” tax records, or opinions without documentation hold little weight with the Board.

Step 4: File Your Appeal Online or In Person

Go to your county Board of Assessors website or office and file your appeal form. You’ll need to choose your preferred appeal path:

Board of Equalization (BOE) — free, most common

Arbitration — costs money, used for higher-value disputes, Most have a certified appraisal

Hearing Officer — for complex or non-residential appeals

You’ll get a confirmation and notice of hearing in the mail.

Step 5: Prepare for Your Hearing (or Let the Appraisal Speak)

At the BOE hearing, the county will present their data and you’ll have a chance to present yours. Many homeowners choose to:

Attend and present their appraisal in person

Or, submit a written statement with documentation

A well-written, independent appraisal is often the most persuasive piece of evidence.

Should You Appeal Your Property Taxes?

If your home is genuinely over-assessed, absolutely. On average, successful appeals can reduce your taxable value by $10,000–$50,000+, which may equal hundreds or thousands in annual savings.

However:

If your assessed value is already below market value, an appeal might not be worth it.

If you can’t provide solid evidence, your case may be denied.

What Is the Best Evidence for a Property Tax Appeal?

A certified appraisal performed by a licensed, local Georgia appraiser

Sold comparables within 6 months of the assessment date

Repair estimates (roof, HVAC, plumbing, etc.)

Interior photos showing needed updates

Evidence of similar homes assessed lower than yours

In most cases, the appraisal is the cornerstone of your appeal.

Now That You Know the Process — Here’s What to Do (Before the Clock Runs Out)

You’ve just learned what most homeowners don’t know about appealing their property tax assessment in Georgia:

How to read your 2026 Annual Notice and appeal it properly

What deadlines matter (and how fast they come)

What kind of evidence actually works in a hearing

Why an independent appraisal is the single strongest document you can present

How to decide whether an appeal is even worth your time

So let’s recap what to do — step-by-step — if you believe your 2026 assessment is too high:

Your 5-Item Tax Appeal Prep List (Georgia Homeowners Edition)

Find your assessment notice and confirm your appeal deadline (45 days from issue date)

Run recent home sales near you — does the county’s value feel inflated?

Schedule a certified tax appeal appraisal before your deadline window closes

Gather photos, estimates, or prior appraisals to support your case

File your appeal online or in-person, and attach your documentation

Is It Worth It to Appeal?

If you're over-assessed, the answer is simple: Yes.

Even a small reduction in assessed value — say $25,000 — can lower your annual tax bill by hundreds. Multiply that by 3 years (the freeze period), and the savings stack up.But if you don’t file on time — or file without solid evidence — you’re stuck overpaying for another year.

Most people never even try — not because they don't qualify, but because they don’t understand how the system works. Now you do.

Our 2026 Appraisal Calendar Is Filling Fast

We limit the number of tax appeal clients we serve in each county to ensure we hit tight deadlines.

Appraisals completed within 5–7 business days

Certified, Georgia-licensed, USPAP-compliant

Designed specifically for tax appeal hearings (not lending)

Includes local comps, condition adjustments, and support for hearing prepDon’t Miss Your 2026 Appeal Window

If your notice arrives in April or May, your appeal deadline is just 45 days away.

Let us help you make a compelling case — with real numbers, not guesswork.

[Click here to request your 2026 tax appeal appraisal]

Slots are limited by county — reserve yours before they're gone.

Get a Certified Tax Appeal Appraisal Before Your Deadline

At REI Valuations & Advisory, we specialize in tax appeal appraisals that hold up under scrutiny. Whether you're appealing in Fulton, Cobb, DeKalb, Gwinnett, or Paulding County, we help homeowners:

Get clarity on market value

Submit evidence that actually works

Save thousands on inflated property taxes

Georgia state-certified appraisals

USPAP-compliant

Fast turnaround — ready before your appeal deadline[Schedule Your Appraisal Today]

Serving Metro Atlanta homeowners. 2026 tax appeal slots are limited.January 25 2026 4:32pm

How a Home Appraisal Affects Your Divorce Settlement in Georgia (2026)Cost, process, and your rights — explained by a certified Georgia appraiser

Introduction

If you're getting divorced in Georgia and you or your spouse own a home, one of the first questions that comes up is:

"How do we divide the house — and how much is it really worth?"

Because Georgia is an equitable distribution state, accurately valuing the home is essential to splitting assets fairly. And that’s where a home appraisal for divorce becomes a necessary step — especially if the property is a major part of the marital estate.

This guide explains what a divorce appraisal includes, who pays for it, how it impacts equity division, and what your options are — based on our experience serving homeowners, attorneys, and mediators across Atlanta and surrounding counties.

What is home equity, and why does it matter in a divorce?

Your home equity is the difference between what your home is worth and what you still owe on your mortgage.

This number is critical because it represents real property value that may be split between spouses in a divorce.

Home value (appraised): $520,000

Remaining mortgage: $300,000

Equity = $220,000

Unless the home was acquired before the marriage and kept entirely separate, that equity is typically considered marital property — and it becomes subject to division.

A professional appraisal is what allows you to determine that $520,000 number with legal credibility.

How is home equity split in a Georgia divorce?

Georgia follows equitable distribution laws, not automatic 50/50 splits.

That means a judge (or mediator) will decide what’s fair — not necessarily equal — based on a number of factors.

These include:

Length of the marriage

Each spouse’s income and financial contributions

Who paid for major renovations or mortgage payments

Who will keep the home (if applicable)

The presence of children or shared debt

Even if both spouses agree on how to divide things, a formal appraisal is often required to make sure the equity split is based on real market data — not opinions or online estimates.

How do home appraisals work in a divorce?

A divorce appraisal is a detailed, certified report prepared by a neutral third-party appraiser who determines your home’s fair market value.

It involves:

Interior and exterior walkthrough

Sales comparison to recent, similar homes

Adjustments for condition, size, upgrades, or location

Optional: retrospective value (value as of separation or filing date)

USPAP-compliant formatting for legal use

Unlike a quick estimate or Realtor CMA, a divorce appraisal is court-ready and can be used in mediation, negotiation, or trial.

Who orders a divorce appraisal — and do both spouses need to agree?

There’s no one-size-fits-all answer in Georgia.

Here are the most common situations:

Mutual agreement: Spouses agree to use one appraiser

Independent reports: Each spouse hires their own

Court-ordered: A judge appoints a neutral appraiser if needed

You can order a divorce appraisal without your spouse’s approval, but if you plan to submit it in court, it may carry more weight if it’s jointly agreed upon.

Who pays for the appraisal during divorce?

There’s no law in Georgia that dictates who must pay.

The most common arrangements are:

Split the fee equally

One spouse pays and gets reimbursed from settlement proceeds

Each spouse pays for their own separate appraisals

Appraisal fees are often treated like any other litigation or mediation cost.

At REI Valuations, we frequently work with both individuals and attorneys to coordinate payment in a way that fits the settlement structure.

How much does a divorce appraisal cost?

In metro Atlanta, the typical divorce home appraisal cost ranges from $450 to $850, depending on:

Property type and complexity

Location (urban vs. rural)

Retrospective valuation needs

Rush turnaround or weekend inspections

Additional forms or testimony requirements

Most standard properties in Cobb, Fulton, Gwinnett, and Douglas counties fall between $550–$675 for full reports delivered in 3–5 business days.

Keep in mind: if you need your appraiser to testify in court, additional fees may apply.

What’s included in a divorce home appraisal?

Every certified divorce appraisal includes:

A fair market valuation supported by recent comparable sales

Photographs of subject and comparables

Adjustments based on features, location, and market trends

Legal documentation that complies with USPAP standards

It’s often delivered in PDF format and can be shared with attorneys, mediators, and the court.

Can you refuse the appraisal amount in a divorce?

You can challenge it — but not based on disagreement alone.

Here’s how you can respond if you believe the value is wrong:

Hire your own appraiser to produce a rebuttal report

Request a review appraisal

Highlight errors or omissions in the original report

Provide additional comparables or evidence through your attorney

Courts won’t accept a simple “I disagree.” You’ll need to offer factual grounds for why the number should be reconsidered.

What happens after the appraisal?

Once the home’s value is confirmed, that number is used to:

Calculate marital equity

Determine buyout amounts

Inform negotiations or property settlement agreements

Serve as a baseline for proceeds splits if the home is sold

In Georgia, equity can be divided through:

Deferred agreements (e.g., one spouse stays until a child graduates, then it’s sold)

Final thoughts

A divorce is hard enough without financial uncertainty. And the family home is often the largest marital asset at stake. A certified divorce appraisal gives you a fair, defensible, and unbiased valuation that can make a difficult process much easier — and protect your financial future.

At REI Valuations & Advisory, we’ve helped dozens of divorcing homeowners, attorneys, and mediators across Atlanta handle this process accurately, quickly, and professionally.

📞 Need a certified divorce appraisal in Georgia?

We offer:

Rush turnaround within 3 business days

Coverage across Fulton, Cobb, Gwinnett, and surrounding counties

Appraisals designed specifically for court or mediation

🎯 Only a few appointment slots available this week.

👉 Request Your Appraisal Now

January 24 2026 5:13pm

Do You Actually Have an IRS-Qualified Appraisal? (Atlanta CPAs & Heirs: Read This Before Filing in 2026)

If you're preparing an estate tax return (Form 706) or gifting property in 2026, and you searched “IRS qualified appraiser near me” — you're not alone. Metro Atlanta CPAs, probate attorneys, and heirs alike often assume that any licensed appraiser can satisfy IRS guidelines. Unfortunately, that's wrong — and it's a costly mistake.

The IRS has tightened standards around what qualifies as a qualified appraisal — and if your report fails the test, you risk rejection, audit exposure, and penalties. In this post, we’ll walk through exactly what qualifies under the latest IRS rules — and how to avoid getting burned.

Don’t file until your appraisal meets these criteria:

✅ Done by a "Qualified Appraiser" per IRS Publication 561

Must hold a state certification (not just trainee or registered)

Must have verifiable qualifications in valuing the type of property appraised

✅ Prepared for a “Qualified Purpose”

✅ Completed on a "Qualified Appraisal Report" Format

Must be in writing, dated, signed, and not self-prepared by the donor

Must use USPAP-compliant methodology (Sales, Cost, or Income Approach)

Must contain detailed market data, comps, and reconciliation

Cannot be a quick comp check or automated valuation

✅ Includes a Credible Effective Date of Value

✅ States Intended Use and Intended Users Clearly

✅ Signed Certification with Penalty-of-Perjury Clause

Yes, the IRS requires it — and yes, it’s often overlooked

What Happens If You Get It Right

If your appraisal meets all the above:

Q: Will the IRS accept a restricted-use appraisal report?

A: No. The IRS explicitly requires a full summary or self-contained report — restricted reports (where only the client is the intended user) are not compliant.

Q: What are the IRS guidelines for a Date of Death appraisal?

A: The appraisal must reflect the property’s fair market value as of the decedent’s date of death. Retrospective appraisals are allowed but must use credible data from that date and include an extraordinary assumption clause.

Q: Who qualifies as a “qualified appraiser” for estate or gift tax?

A: According to IRS Pub 561 and the Pension Protection Act, a qualified appraiser must:

Q: Can I use the same appraisal for both the estate and charitable contribution?

A: Possibly, but only if both uses were disclosed and the appraisal meets all qualified criteria — and includes all required certification and intended user language.

If you're filing Form 706 or 709 this year — don’t gamble with an unqualified report.

At REI Valuations & Advisory, we specialize in IRS-compliant appraisals for estate, gift, and charitable tax purposes — all across metro Atlanta. We work directly with CPAs, fiduciaries, and heirs, and our reports are built to withstand IRS scrutiny.

Guaranteed IRS-Compliant — or your money back

72-Hour Turnaround Available — limited to 3 slots/week

Free Consultation — to review your needs before engagement

Bonus: Get a complimentary IRS Checklist PDF with every order this month

👉 Claim Your Spot Now: Or Call/Text: (404) 692-3878 — Limited capacity for February 2026

January 22 2026 8:42pm

Dividing the House in a Divorce? Here’s What to Know About Getting an Accurate Home Appraisal in 2026 Atlanta

Wondering how much your home is really worth — and how that affects your divorce settlement? Whether you’re planning to sell, buy out your spouse, or simply protect your share of the equity, getting the right type of home appraisal could make or break your outcome. And in Atlanta’s volatile 2026 real estate market, vague online estimates won’t cut it — especially when equity division, legal deadlines, and court scrutiny are involved.

Here’s what divorcing homeowners in Georgia need to know right now — including who orders the appraisal, how detailed it needs to be, who pays for it, and what happens if the numbers don’t match up.

Step-by-Step: How to Navigate a Divorce Home Appraisal When Ownership & Equity Are in Question

Step 1: Identify Who’s on Title and Who Actually Has a Claim

You might be surprised: just because one person’s name is missing from the deed doesn’t mean they don’t have a right to the equity. Georgia is an equitable distribution state, which means property acquired during the marriage — even if it's only titled in one spouse's name — may still be considered marital property.

If you or your spouse bought the home during the marriage, even if one of you isn’t on the title, that value may still be divided.

If the home was purchased before marriage but commingled funds were used (e.g. mortgage paid from joint account), things can get legally murky.

Before you appraise anything, confirm how title is held — and more importantly, whether there’s a valid claim to equity from both sides.

Step 2: Get a Certified Divorce Appraisal (Not a Zillow Estimate)

This isn’t the time for shortcuts or quick online calculators. A divorce appraisal is different than a refinance or listing appraisal. It needs to be:

Neutral (not biased toward either spouse)

Based on recent sales of comparable properties in your local Atlanta market

A good appraiser will also provide adjustments and commentary that account for unique property features, market timing, and recent upgrades — not just a one-line number.

Expect a certified divorce appraisal to cost $450–$750+ in metro Atlanta, depending on property complexity. This is a professional report designed to hold up in mediation or litigation, not a rough number for negotiations.

Step 3: Decide Who Orders — and Who Pays

In Georgia, either party can order the appraisal — but most attorneys and mediators prefer a jointly ordered appraisal from a neutral, third-party appraiser.

If each side gets their own appraisal, courts may throw out both and order a third one anyway. That’s three times the cost.

Best practice? Both parties agree on one appraiser and split the cost 50/50. This ensures neutrality and reduces the risk of value disputes.

Step 4: Prepare for a Buyout or Sale — and Know the Value May Be Contested

If one spouse wants to keep the home, the appraised value becomes the baseline for a buyout calculation:

But what if you don’t agree with the appraisal?

You can dispute the value — but you’ll need strong data (comparable sales, condition photos, etc.). Courts won’t entertain vague feelings or “it should be worth more because…”

In some cases, a second appraisal is ordered, or a mediator averages both values. But remember: time, money, and conflict go up when appraisals clash — and divorce already brings enough of all three.

Now You Know: What You Really Came For

If you’ve made it this far, here’s what you now have clarity on — in plain language:

Who orders a divorce appraisal? Either party can, but a neutral, joint appraisal is best.

Who pays for it? Often split 50/50, or covered by one party as agreed during proceedings.

How much does a divorce appraisal cost in Atlanta? Expect $450–$750+ depending on home type.

How detailed is it? Very. Divorce appraisals must stand up to legal review, so they’re far more detailed than online estimates or agent CMAs.

Can you dispute the value? Yes, but you’ll need evidence — not just opinions.

What if one spouse isn’t on the title? They may still have equity rights, depending on when and how the home was acquired.

What if you’re buying out your spouse? That appraisal anchors the entire deal. Get it right the first time.

Need a Divorce Appraisal Fast — and Done Right the First Time?

At REI Valuations & Advisory, we specialize in neutral, court-ready divorce appraisals across Metro Atlanta. Our appraisals are certified, fully USPAP-compliant, and designed to protect all parties involved — with turnaround options in as fast as 2 business days.

Appointments available this week — but limited to 3 divorce cases per week for quality control.

👉 Request Your Divorce Appraisal Now

Or call/text (404) 692-3878 — We’ll walk you through the process in 5 minutes flat.

January 21 2026 7:32pm

How is Home Equity Split in a Divorce? | 5 Things to Know About Valuing a House During Divorce in Atlanta, Georgia (2026)

Dividing home equity during a divorce in Atlanta, Georgia can get messy—fast. Whether you’re planning to buy out your spouse, sell and split proceeds, or determine the fair market value for court filings, there’s one unavoidable step: valuing the marital property correctly. And in 2026, courts, attorneys, and mediators in Georgia are all looking for the same thing—a credible, defensible home appraisal that reflects today’s market.

In this post, we break down the top five things you need to know about valuing and splitting real estate in a divorce. Whether you're searching for answers to “How do I calculate house value in a divorce?” or “Is an appraisal the same as fair market value?”, this guide covers it all—directly, clearly, and based on what’s happening right now in metro Atlanta.

1. The Court Doesn’t Use Zillow or Redfin—They Use a Certified Appraisal

Online estimates won’t hold up in a contested divorce case. Georgia family courts and attorneys typically require a Certified Residential Appraisal Report completed by a licensed appraiser, especially when the property is being divided as part of the marital estate.

The appraisal determines the fair market value—what a typical buyer would pay for the home today in its current condition and location. This is different from assessed value (used for taxes) or refinance value (used by lenders).

2. You’ll Need to Define the Date of Value

In Atlanta divorces, the valuation date could be:

The date of filing

Or the current date, depending on legal guidance

Choosing the wrong date can drastically skew the value. Home values fluctuate monthly in 2026, especially in fast-changing metro areas like East Atlanta, Marietta, and Sandy Springs.

We always confirm this with attorneys or parties ahead of time—because a $25,000 swing in value can shift the entire equity split.

3. Equity Is What’s Left After Debt

Let’s say your home appraises for $650,000. If the mortgage payoff is $430,000, then you have $220,000 in net equity. That’s the amount that’s typically divided between spouses—either by selling the home or having one party “buy out” the other.

✅ Tip: Always verify your loan payoff amount in writing. Don’t guess.

4. Buyouts Are Based on Net Equity—Not Just Value

If you’re staying in the home, your attorney may structure a buyout where you pay your spouse for their half of the equity. In the above example, that might be $110,000 (half of $220K).

This is where the appraisal becomes critical. If you believe the home is worth $600K but your spouse believes it's worth $700K, you need a neutral, professional third-party opinion to avoid disputes.

5. The Appraisal Is the Fair Market Value (When Done Right)

Many divorcing couples ask, “Is an appraisal the same as fair market value?”

Answer: Yes—if it’s done by a qualified, local expert. At REI Valuations, our divorce appraisal reports meet Georgia court standards and are built to withstand scrutiny from judges, attorneys, and mediators.

We don’t just fill out forms—we write legal-style narrative reports that explain your home’s value with clarity, comps, and condition details specific to Atlanta’s 2026 market.

How to Actually Walk Away Fair in an Atlanta Divorce (2026)

Now that you know what goes into splitting home equity during divorce—how it’s appraised, how timing impacts value, how buyouts work—it’s time to actually use it.

Here’s what no one tells you:

When equity is on the table, confusion is profitable—but not for you. The less you understand, the more risk you take. The more risk you take, the more leverage you lose. And in Atlanta’s real estate market in 2026, with prices shifting block by block, that leverage gap can turn into tens of thousands of dollars lost—or gained.

So here’s how to protect yourself:

Get agreement on the appraisal upfront.

If both parties and attorneys agree to use a neutral, certified appraiser from the start, the rest of the process becomes 10× faster, cheaper, and more amicable. No courtroom tug-of-war. No dueling reports. Just facts.Don’t let the wrong date decide your future.

The value of your home on January 5th, 2026, could be $25K different than it was on October 15th, 2025. That difference? It doesn't just affect value—it affects who walks away with what. Make sure the appraisal matches the legal date you actually need. Most don’t.Think in net—not gross—terms.

What looks like $200K in equity becomes $140K fast when you account for mortgage payoffs, liens, and agent fees if sold. And if one party’s “buyout” doesn’t factor in needed repairs? They just inherited a money pit.Don't just win the house—win your next chapter.

Keeping the home feels safe. But if it leaves you house-rich and cash-poor, that comfort turns to chaos fast. A good appraisal isn’t just about proving value. It’s about helping you decide: “What do I actually want to carry forward into the next season of my life?”Get it in writing—backed by numbers.

In divorce, memories conflict. Opinions conflict. Stories conflict. But a signed, court-ready appraisal written by a certified professional? That holds. It protects. It settles. It saves months of stress.

You don’t need to become an expert on Georgia divorce law or housing trends in Fulton County. You just need the right data, in the right format, delivered by someone who speaks both legal and local.

Because at the end of the day, you’re not just splitting a house.

You’re rebalancing a life.

Make sure the numbers—and the story behind them—are right.

Need an Appraisal for Divorce in Atlanta? Here’s What to Do Next

We offer divorce-focused home appraisals across Atlanta, Cobb, DeKalb, Gwinnett, and Fulton counties. Each report includes:

A full market analysis

On-site inspection

Expert reconciliation of home features and condition

Delivery within 3–5 business days

January slots are filling fast. If you need a credible report to support a fair settlement or buyout, we recommend booking an appraisal consult within the next 48 hours.

Bonus: Ask about our Court-Ready Package, which includes additional PDF copies, digital notarization, and court testimony support if needed.

Click here to schedule a Free 30-Minute Appraisal Fit Call »

January 19 8:26pm 2026

The 5 Steps to Getting an IRS-Qualified Appraisal for Estate Tax Filings in Atlanta (2026 Update)Why most families and CPAs get this wrong—and how to protect your legacy from IRS scrutiny.

If you're filing IRS Form 706 in 2026 or managing an estate with real property in Atlanta, Georgia, the IRS now requires a qualified appraisal by a qualified appraiser—and most generic home appraisals won't cut it. Whether you're stepping up basis, reporting estate tax, or defending value in an audit, the appraisal must meet strict IRS standards, including retrospective valuation to the date of death, legal formatting, and specific certification language. In Georgia, few appraisers specialize in this. At REI Valuations, we deliver IRS-compliant reports trusted by estate attorneys, CPAs, and fiduciaries across Metro Atlanta.

Step 1: Confirm Whether an IRS-Compliant Appraisal Is Even Required

Many heirs, executors, and even attorneys mistakenly assume a basic home value estimate will suffice. But if you're filing IRS Form 706 or stepping up basis for capital gains purposes, the IRS explicitly requires a “qualified appraisal prepared by a qualified appraiser” under 26 CFR §1.170A-17. If you're handling any of the following, you likely do need one:

Filing Form 706 for estate tax

Gift tax reporting over annual exclusion

Charitable donation of real property

Establishing a step-up in basis for future sale

Defending real estate values in audit scenarios

If you're unsure, confirm with your CPA—but assume the IRS will want defensible documentation, not a Zestimate or informal CMA.

Step 2: Understand What the IRS Means by “Qualified Appraiser”

This is not just any licensed appraiser. The IRS requires that the appraiser:

Has earned a state license or certification (i.e., Certified Residential or Certified General)

Is not related to the estate or property

Has verifiable experience with the property type

Has no prohibited financial interest in the outcome

In Georgia, this means using a state-certified appraiser with direct experience in date-of-death valuations and IRS-compliant formats. At REI Valuations, we meet all of these requirements and more.

Step 3: Order the Right Appraisal Format—Not Just Any Report

Here’s where 80% of families make mistakes.

The IRS will not accept a restricted-use appraisal if it doesn’t meet the “qualified appraisal” definition under IRS rules. Even if your appraiser is licensed, the report must also include:

The effective date clearly tied to the date of death (retrospective)

Market-supported adjustments and reconciliation

A credible scope of work and intended use for IRS and estate tax purposes

At REI Valuations, we draft our reports in legal-narrative format, aligning directly with IRS submission expectations—not just Fannie Mae checkboxes.

Step 4: Verify That the Appraisal Matches the IRS Filing Timeline

This is crucial.

Your effective date must match the decedent’s date of death. Your appraisal must be retrospective, and your appraiser must be willing to state in writing that the valuation is based on that retrospective date—even if the inspection occurred later.

If you're filing Form 706, the appraisal must be included within 9 months of the date of death unless you’ve requested an extension. Don't risk delays or penalties due to timing errors.

Step 5: Choose an Appraiser Willing to Defend Their Work

If your estate is selected for audit, the IRS may request clarification or supporting documentation. You need an appraiser who:

Stands behind their report under oath if needed

Is willing to supply additional documentation

Understands the legal implications of their work

Has experience dealing with fiduciaries, CPAs, and estate attorneys

That’s why many Georgia estate planners, CPAs, and fiduciaries choose REI Valuations. We don’t just issue a number—we defend it, with legal-grade narrative support, proper citations, and IRS-aligned formatting.

Let’s answer your most pressing questions directly:

Will the IRS accept a restricted appraisal report?

No—unless it still meets the full requirements of a “qualified appraisal” under IRS guidelines. Most restricted-use reports do not qualify.What are the Form 706 appraisal requirements?

The appraisal must be retrospective to the date of death, performed by a qualified appraiser, and formatted with sufficient market data, certification, and documentation per IRS regs.Who is a qualified appraiser for IRS purposes?

In Georgia, that means a state-certified or licensed appraiser with real-world experience and legal report formats, not a trainee or someone who only does mortgage work.Can I use a charitable contribution appraisal for estate tax filings?

Only if it meets the same “qualified appraisal” standard. The intended use must be clearly stated and align with IRS needs.Where can I find an IRS-qualified appraiser near me in Atlanta?

You’re here. REI Valuations & Advisory specializes in estate and tax-related appraisal work throughout Atlanta and across Georgia, and we’re available for priority scheduling now.

Now Booking 2026 Estate & Probate Appraisals Across Georgia

If you're preparing a 2025–2026 estate tax filing, don't wait until the IRS deadline is breathing down your neck. We offer:

Priority estate scheduling slots

IRS-qualified reports, certified & signed

Audit-defensible legal narrative format

Request your appraisal consultation now. Our calendar fills quickly with court and IRS deadlines—secure your time slot today.

January 18th 2026 6:02pm

Atlanta Divorce Appraisal Requirements Have Changed in 2026 — Here’s What Every Homeowner Needs to Know Before They Lose Equity, Time, or Leverage

You’re going through a divorce in Atlanta, Georgia, and the court is asking for an appraisal. But here’s the problem in 2026: Georgia judges are no longer accepting cookie-cutter appraisal forms, and attorneys are pushing back on outdated or lender-based reports. If you hire the wrong appraiser, you risk undervaluing your home, delaying your case, or losing negotiating power — permanently. This isn’t just a formality. It’s a financial chess move, and the outcome can shape your future. In this guide, we’ll break down exactly what you need, why most appraisals won’t cut it, and how REI Valuations solves it — start to finish.

10 Critical Divorce Appraisal Facts Every Atlanta Homeowner Must Know in 2026

1. Zillow Won’t Cut It (and Could Cost You Thousands)

Courts, attorneys, and mediators are rejecting online estimates in 2026. Zillow, Redfin, and Realtor.com are considered unreliable for legal purposes. You need a certified, USPAP-compliant appraisal from a licensed professional — not a Zestimate.

2. Most Appraisers in Georgia Don’t Specialize in Divorce Work

Over 80% of appraisers focus on lender work, not legal assignments. That’s a major problem. Lender reports are formatted for banks — not for courts, attorneys, or IRS scrutiny. You need a firm like REI Valuations that does nothing but non-lender legal appraisals.

3. You May Need a Retrospective Value (Not Today’s Value)

If your divorce was filed months or years ago, the court may require a value as of that date — not the current market. This is called a retrospective appraisal, and few appraisers offer it. We do.

4. Disagreements Are Common — Get Ahead of It

If your spouse hires their own appraiser and it conflicts with yours, you’ll need an expert to rebut or defend your valuation. We offer consultation-ready appraisals with backup documentation, supportable adjustments, and expert witness-ready language.

5. Your Attorney May Be an Intended User — Include Them Upfront

To make your appraisal fully admissible and accessible, the report should list you, your attorney, and the court as intended users. We handle this in every report. Most generic appraisers don’t.

6. Georgia Courts Now Expect Legal-Format Reports in 2026

As of 2026, many judges in Fulton, Cobb, and DeKalb are scrutinizing poorly formatted appraisals. We prepare narrative or restricted-use reports that meet modern court expectations and avoid delays or rejections.

7. Speed Matters — But So Does Accuracy

You can’t afford to wait weeks during a contested divorce. REI Valuations offers 48–72 hour turnaround options for time-sensitive filings — without sacrificing the legal formatting you’ll need to win support or division disputes.

8. The Right Format Depends on Your Legal Goals

Need to negotiate? Use a restricted-use report to save time and money

Going to court? Get a narrative full report with all intended users named

We’ll help you choose the format based on your exact situation — not just sell you a template.

9. You Can Use One Appraiser for Both Parties — If You Trust Them

We offer dual-party neutral engagements where both spouses agree to share the cost and use a single certified appraiser. This can save money, avoid conflict, and streamline your process — but only if you work with a firm trusted by both sides.

10. This Is a Legal Tool — Not a Real Estate Transaction

Divorce appraisals are about evidence, not estimates. You’re not just trying to find a price — you’re trying to document equity, establish fairness, and protect your financial future. That’s why REI Valuations exists — to deliver appraisal reports that actually hold up under scrutiny and give you peace of mind.

What Every Atlanta Homeowner Going Through Divorce Needs to Know (And Do) Right Now

If you're searching for a "divorce appraisal near me" or asking how to protect your equity during a divorce, here’s what you’re really trying to solve:

You need a certified, court-acceptable value of your home

You want to avoid disputes, delays, or legal objections later on

You want someone objective — not influenced by your ex or their attorney

You want this handled fast, legally correct, and affordably

Here’s exactly what you need to do, and why REI Valuations & Advisory is the only firm in Atlanta you want handling this:

What Type of Appraisal Do You Actually Need?

Most homeowners don’t know this, but there are two types of appraisals:

Lender Appraisals (used for refinancing or home loans)

Legal Appraisals (used in divorce, estate, tax, or litigation cases)

Only Legal Appraisals will meet court standards. Most local appraisers won’t tell you this — they just quote you a fee and send over a generic form that won’t be admissible in court or useful in settlement negotiations.

REI Valuations specializes in legal-format appraisals, including:

Retrospective Valuations (backdated to separation or filing date)

Narrative Legal Reports, not just “checkbox” forms

Multiple Intended Users (for both attorneys, spouses, and the court)

Restrictive-Use Formats when privacy and cost-control matter

Full USPAP compliance, signed by a Georgia-licensed appraiser

What If You and Your Spouse Don’t Agree?

One of the biggest problems in divorce is appraisal disputes.

Maybe one party wants to use Zillow.

Maybe the other got a “free CMA” from a Realtor.

Maybe your spouse hired their own appraiser who lowballed it.

REI Valuations provides:

Independent, unbiased valuations that can be used jointly

Professional-grade rebuttals to challenge low or biased appraisals

Dual-party engagement options (when both spouses want shared cost and access)

We even include an optional consultation add-on for attorneys or mediators who need clarification on how we arrived at the value.

How Long Will It Take? Will It Delay My Case?

Court cases and mediation don’t wait — and neither do we.

At REI Valuations, we offer:

Expedited 48–72 hour turnarounds available

Priority scheduling for court-involved assignments

Real-time inspection updates so both parties stay informed

Clear deadlines on every stage of delivery — no guesswork

How Much Will It Cost?

This depends on complexity, but unlike most firms, we offer transparent, package-based pricing:

Standard Divorce Appraisal: $495–$645 flat

Retrospective or Complex Appraisals: starting at $695

Multi-property or land assets? Custom quotes available

Bonus: Every appraisal includes a complimentary Appraiser Fit Call™ to assess your needs before payment.

No surprise add-ons.

No upsells.

Court-tested report formats only.

Why REI Valuations is Atlanta’s Divorce Appraisal Firm of Record (2026 and Beyond)

Most appraisal firms handle lender work. We don't.

We built REI Valuations specifically for legal, non-lender assignments like:

Divorce

Probate & Estate

IRS & Tax Filings

Expert Witness & Mediation Support

We don’t cut corners, and we don’t ghost clients. We walk with you from first consultation to final resolution — and we’ve helped over 100 Georgia families in situations just like yours.

Your Next Step (Do Not Skip This)

Whether you're early in your divorce or facing a court deadline...

→ Book a free 30-minute Appraiser Fit Call™ now to get your questions answered, timeline locked in, and quote delivered.

January 2026 slots are filling up due to high seasonal demand.

Book this month and get a $50 closing credit or legal Q&A bonus (your choice).

Click below to schedule your free consultation

Certified. Court-Ready. Built for Divorce.

Serving Atlanta & surrounding counties with urgency, empathy, and legal precision.

January 17 2026 9:31pm

Home Appraisal for Divorce in Atlanta, Georgia (2026): What Judges and Attorneys Expect — And What Homeowners Need to Know Before It’s Too Late

If you're going through a divorce in Georgia and the house is on the table, a home appraisal isn't optional — it's evidence. And whether you're in mediation or headed to Fulton County Family Court, the appraisal you submit will be judged — literally — by the legal system. In 2026, Atlanta-area judges and divorce attorneys expect appraisals to meet strict standards: from who orders them, to how they're formatted, to how much they cost, and whether they can be challenged in court. Here's what you need to know before you order the wrong kind of report.

6 Key Steps to Navigating Divorce Appraisals in Atlanta Courts

Step 1: Understand That Divorce Appraisals Are Legal Evidence

In Georgia, a divorce appraisal isn’t just a price opinion — it’s a piece of legal documentation that may be used to determine how assets are split. Judges expect a credible, USPAP-compliant appraisal with a clearly stated intended use for “divorce settlement purposes.” Reports that don’t meet that standard may be dismissed or heavily scrutinized in court.

Step 2: Know Who Orders the Appraisal (And How It Affects Admissibility)

In most Atlanta divorce cases, either spouse can order the appraisal independently — but attorneys and judges prefer jointly ordered reports when possible, especially to avoid future objections. If both parties hire separate appraisers, courts may require a third neutral appraisal to settle the dispute. Judges favor transparency and neutrality.

Step 3: Set Clear Expectations on Cost (And Who Pays)

Divorce appraisal costs in Atlanta typically range from $450 to $900, depending on the complexity, urgency, and report format. Payment is often split 50/50 when ordered jointly. When one party pays alone, the report may be viewed as less neutral — something judges and attorneys flag quickly. Always disclose the payment arrangement if the report is to be submitted in court.

Step 4: Make Sure the Appraisal Is Detailed and Court-Ready

Georgia judges expect appraisals to go beyond box-checking. That means:

Full market analysis

Neighborhood commentary

Photos and comparable sales

Legal-format narrative addenda

Clear adjustments and final value reconciliation

A simple refinance-style appraisal won’t cut it in court.

Step 5: Understand How Appraisals Can Be Challenged

If one party disputes the appraisal value, they can request a second opinion, file a rebuttal, or call the appraiser into court. Judges will evaluate the credibility, methodology, and scope of work of each report. Reports lacking clarity or defensible analysis often backfire on the party who submitted them.

Step 6: Use Local Appraisers Familiar With Atlanta Courts

Judges are more likely to trust appraisers who are familiar with local market dynamics, understand Georgia’s equitable distribution laws, and specialize in non-lending legal appraisal formats. Out-of-town or “form-only” appraisers can trigger questions or even get reports tossed out entirely.

Now that you understand how Atlanta courts evaluate divorce appraisals — from who orders them to what format judges expect — let’s get into the part most homeowners really want to know.

Whether you’re working with an attorney, going through mediation, or handling this on your own, here are the questions we hear most from clients across Georgia. These aren’t just technical details — they’re the real-world concerns that could impact how much equity you walk away with, how fast your case moves forward, and how reliable your appraisal truly is.

Let’s break them down one by one:

Q: How much does a divorce appraisal cost in Atlanta?

A: Divorce appraisals in Georgia typically range from $450 to $900 depending on the property type, report format, urgency, and whether the report includes retrospective or expert narrative components. Higher-end assignments or rush requests may exceed $1,000, especially when court appearances or rebuttal responses are involved.

Q: Who pays for the appraisal in a divorce?

A: It depends. When both spouses agree to hire one neutral appraiser, they often split the cost 50/50. If each spouse hires their own, they pay individually. Judges prefer transparency — and joint orders reduce the risk of value disputes. If one party pays alone, they should be prepared to disclose that to the court.

Q: Who actually orders the appraisal — the homeowner or the attorney?

A: Either one can. But in legal cases, most appraisers (like us) require confirmation from at least one attorney before proceeding — to ensure the intended use, delivery expectations, and legal standards are all in sync. Some courts even require that the attorneys agree on the appraiser in advance.

Q: Can you refuse or contest the appraised value?

A: Yes — but you'll need more than just disagreement. You may submit a rebuttal report, request a second opinion, or challenge the original report’s methodology in court. However, if your appraiser followed USPAP, documented the work file, and prepared a clean, legal-format report, judges are unlikely to discard it without cause.

Q: How detailed is a divorce appraisal supposed to be?

A: Very. Unlike lending reports, divorce appraisals must be legally defensible, often include retrospective components (e.g. value as of separation), and require full narrative sections, neighborhood analysis, comparable breakdowns, market conditions, and signed certifications. The report must clearly state its intended use: divorce settlement support.

Ready to Protect Your Interests With a Court-Ready Divorce Appraisal?

At REI Valuations & Advisory, we specialize in legal-format divorce appraisals for Atlanta homeowners — designed to hold up in mediation, negotiation, and Fulton County courtrooms.

Guaranteed Court-Ready Format (or we revise it free)

Bonus: Get our “Divorce Appraisal Prep Sheet” included at no cost

Priority Booking: Only 3 court-ready divorce reports accepted per week

Avoid Delays: Most appraisals delivered within 5 business days→ Book your free 30-minute Appraisal Fit Call today to see if we’re the right fit — and avoid costly mistakes before court.

January 15 2026 7:37pm

IRS Qualified Appraiser Near You in Atlanta, Georgia — 2026 Guide to Date of Death Appraisals for Estate and Probate

If you're searching for an "IRS qualified appraiser near me" in Atlanta, Georgia for a date of death real estate appraisal in 2026 — this article answers exactly what the IRS requires, who qualifies, and how to make sure your estate, probate, or tax filing won’t be delayed, rejected, or audited.

This is a subtopic of estate and probate valuations—specifically, how the IRS treats appraisals when someone passes away, and what families, CPAs, and attorneys in Georgia need to know in 2026.

What Makes an Appraiser “IRS Qualified” in 2026?

Let’s start with the facts. The IRS doesn’t accept just any appraiser. According to the latest 2026 standards (Publication 561 + Form 706 Instructions), an IRS-qualified appraiser must:

Be licensed or certified in the state where the property is located — for Georgia estates, that means a Georgia appraiser

Regularly perform appraisals for compensation

Be independent (no interest in the property or estate)

Provide a signed report that follows USPAP (Uniform Standards of Professional Appraisal Practice)

Use accepted methodology, including comps, market analysis, and valuation narrative

Deliver a credible written appraisal that can be reviewed or audited by the IRS

A broker’s opinion, Zillow estimate, or informal market report does not qualify.

Story: The CPA Who Trusted the Wrong Appraiser (and Paid for It)

In early 2025, a family in Decatur inherited a triplex and used a quick $350 “desktop appraisal” from a local broker for IRS Form 706. The report was two pages long and used investor-friendly ARV logic instead of comparable sales.

When the IRS reviewed the estate filing, they rejected the valuation. The family had to pay for a second appraisal, refile the 706, and their CPA had to justify the delay. It added 4 months of stress and delayed final disbursement of funds to heirs.

Lesson learned? The IRS has strict standards, and shortcuts don’t work.

Do You Need a Date of Death Appraisal?

Here’s who must get a compliant date of death appraisal in 2026:

Heirs and executors managing real estate within an estate

CPAs preparing IRS Form 706 or handling step-up in basis

Attorneys assisting with probate filings or asset division

Trustees or fiduciaries who need defensible valuation for property in a trust

Any family member planning to sell inherited property and avoid tax penalties

What the IRS Wants (List of Appraisal Requirements)

The IRS isn’t vague. Here’s what must be included in a compliant appraisal:

✅ Effective date as of the date of death (or alternate valuation date if elected)

✅ Market area and condition as it existed on that date

✅ Comparable sales, with time and location proximity

✅ Narrative justification for adjustments, location, and valuation method

✅ A signed USPAP certification page from the appraiser

✅ Clear intended use: “For IRS filing and estate settlement purposes”

In short: it must tell the story of the market as it existed on the decedent’s date of death, not the date of the report.

Story: West End Property — One Block Made a $70K Difference

We recently appraised two properties for the same estate in the West End Historic District of Atlanta. Both were 3-bed bungalows built in 1920. One sat inside the BeltLine overlay; the other was a block outside.

Guess what?

The property inside the BeltLine overlay commanded $70K more in market value due to zoning incentives and walkability.

If your appraiser isn’t aware of Atlanta’s micro-market boundaries, you’re gambling with your estate tax liability.

Is a Restricted-Use Appraisal Acceptable for IRS?

Restricted reports limit both scope and intended user. The IRS is not the intended user in most restricted reports, and therefore they are not valid for:

IRS Form 706